Panoramic Tax-Managed Models

11 Risk-Adjusted, Globally-Diversified Models

PANORAMIC TAX-MANAGED MODELS

Though markets have historically rewarded patient, long-term investors, there are no guarantees when it comes to investment returns. On the other hand, taxes are an almost inescapable reality—one that can eat away at returns and create a headwind that slows progress toward your financial goals. The good news is that there are strategies and solutions that can help minimize taxes and maximize after-tax returns.

Symmetry’s Panoramic Tax-Managed Funds and Models are designed to increase the tax efficiency of your portfolio and enhance your ability to achieve your financial objectives. They employ the same evidence-based strategy that characterizes all of the firm’s solutions but with a special focus on reducing the negative impact of taxes on overall returns.

MULTIPLE STRATEGIES FOR REDUCING THE IMPACT OF TAXES

Buying and selling holdings within a portfolio can result in substantial taxable capital gains that erode after-tax returns. Panoramic invests for the long-term and avoids trying to outguess the market—meaning turnover stays low.

Panoramic managers can also reduce tax liability by taking advantage of short-term fluctuations in stock prices. When a security’s price drops below

its purchase price, or cost basis, the security is in an unrealized loss position. In the event of a tax liability, a position held at an unrealized loss can be sold to offset some or all of the gain and reduce taxes payable.

A portfolio’s total position in a security can consist of shares purchased on different dates and at different prices. By selling tax lots with a higher cost basis before those with a lower cost basis, Panoramic managers defer taxes due on the shares that would generate the highest taxable gains, potentially improving after-tax return.

Every day, we seek to match purchases with redemptions. Combining this with efficient cash

management makes it possible to reduce actual turnover within the fund, thereby reducing costs and taxes.

Selling investments held less than one year trigger a short-term gain that is taxed as ordinary income, (this rate is more than 40% for investors in the highest tax bracket). Investments sold after the one-year holding period are taxed at a lower long-term capital gains rate (23.8% for those in the highest tax bracket). Consequently, our managers seek to avoid sales that would result in short-term gains.

In addition, several of the Panoramic equity funds include sleeves sub-advised by AQR and Dimensional Fund Advisors (from which capital gains distributions are made directly to Panoramic) enhancing our ability to implement tax management strategies and distribute gains to clients in the following year.

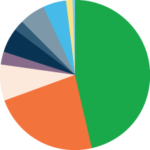

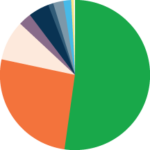

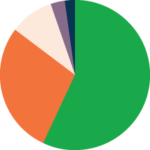

Panoramic Tax-Managed portfolio models

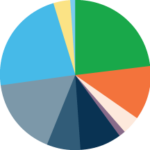

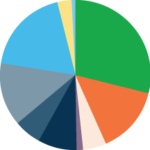

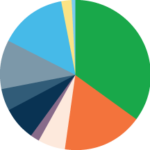

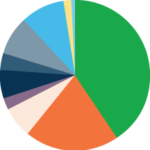

The Panoramic Tax-Managed Portfolio Models are broadly diversified and strategically allocated and designed with the goal of maximizing after-tax returns. Built with Panoramic Funds and using the same Evidence-Based, data-driven investment approach, they employ an exclusive blend of Money Managers and offer a world of smart diversification with:

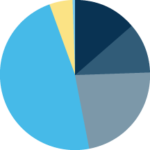

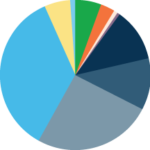

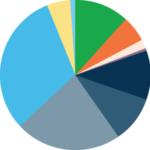

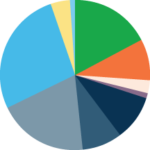

| Capital Preservation 0/100 | Conservative 10/90 | Conservative 20/80 | Conservative 30/70 | Conservative Growth 40/60 | Conservative Growth 50/50 | Moderate 60/40 | Moderate Growth 70/30 | Growth 80/20 | Growth 90/10 | Aggressive Growth 100/0 | |

| US Equity | 5.8% | 11.7% | 17.4% | 23.3% | 29.1% | 35.3% | 40.8% | 46.6% | 52.4% | 57.0% | |

| Int'l. Developed Equity | 2.9% | 5.7% | 8.7% | 11.6% | 14.4% | 16.3% | 20.2% | 23.1% | 26.0% | 28.3% | |

| Emerging Market Equity | 1.0% | 1.9% | 2.9% | 3.9% | 4.8% | 5.3% | 6.8% | 7.7% | 8.7% | 9.5% | |

| REITs | 0.3% | 0.6% | 1.0% | 1.3% | 1.6% | 3.1% | 2.3% | 2.6% | 2.9% | 3.2% | |

| Short-Term Fixed Income & Cash | 13.8% | 11.4% | 10.6% | 9.8% | 9.0% | 8.2% | 4.3% | 6.3% | 5.4% | 4.4% | 2.0% |

| Corporate Bonds | 10.7% | 11.3% | 10.0% | 8.6% | 7.2% | 5.9% | 8.6% | 3.5% | 2.3% | 0.9% | |

| Government Bonds | 22.6% | 25.5% | 22.5% | 19.5% | 16.5% | 13.6% | 20.8% | 8.4% | 5.6% | 2.2% | |

| Municipal Bonds | 47.6% | 35.2% | 31.0% | 26.9% | 22.7% | 18.6% | 0.1% | 9.3% | 4.9% | 1.8% | |

| Securitized Debt | 4.8% | 5.5% | 4.9% | 4.2% | 3.6% | 3.0% | 4.7% | 1.9% | 1.3% | 0.5% | |

| Fixed Income Forwards/Futures | 0.5% | 1.1% | 1.0% | 0.9% | 0.9% | 0.7% | 1.5% | 0.6% | 0.5% | 0.2% | |

Our Expertise

The Tax-Managed Mutual Funds and Models are built using a best-of-breed selection of noted money managers, each of whom offers unique expertise in:

- Leveraging the 8 factors of return identified by academic science as helping to decrease risk and/ or increase potential returns.*

- Smart tax-managed strategies that may significantly reduce how much you lose to taxes each year

* Symmetry Partners’ investment approach seeks enhanced returns by overweighting assets that exhibit characteristics that tend to be in accordance with one or more “factors” identified in academic research as historically associated with higher returns. Please be advised that adding these factors may not ensure increased return over a market weighted investment and may lead to underperformance relative to the benchmark over the investor’s time horizon. The factors Symmetry seeks to capture may change over time at its discretion. Currently, the major factors in equity markets used by Symmetry and some associated academic research are: market (Sharpe, William F. “Capital Asset Prices: A Theory of Market Equilibrium under Conditions of Risk,” Journal of Finance, Vol. 19, No. 3 (Sept. 1964), 425-442.); market, size, value profitability, and investment (Fama, Eugene and Ken French. “A Five-factor Asset Pricing Model,” Journal of Financial Economics, Vol. 116, (Apr. 2015), 1-22.); size (Asness, Clifford., Andrea Frazzini, Ronen Israel, Tobias Moskowitz, and Lasse Pedersen “Size Matters, If You Control Your Junk,” Journal of Financial Economics, Vol. 129 (Sept. 2018), 479-509); profitability (Novy-Marx, Robert. “The Other Side of Value: The Gross Profitability Premium,” Journal of Financial Economics, Vol. 108 (Apr. 2013), 1-28); quality (Asness, Clifford S., Andrea Frazzini, and Lasse H. Pedersen. “Quality Minus Junk,” Review of Accounting Studies, Vol. 24 (Nov. 2018), 34-112); momentum (Jegadeesh, Narasimhan and Sheridan Titman. “Returns to Buying Winners and Selling Losers: Implications for Stock Market Efficiency,” Journal of Finance, Vol. 48, (March 1993), 65-91); minimum volatility (Ang, Andrew., Robert J. Hodrick, Yuhang Xing and Xiaoyan Zhang. “The Cross-Section of Volatility and Expected Returns,” Journal of Finance, Vol. 61 (Feb. 2006), 259-299.) In the bond markets, the major factors used by Symmetry are: maturity and credit (Ilmanen, Antti. “Expected Returns: An Investor’s Guide to Harvesting Market Rewards,” Wiley Finance (2011), 157-158 and 183-185.); value, quality, and momentum (Brooks Jordan., Diogo Palhares, and Scott Richardson. “Style Investing in Fixed Income,” Journal of Portfolio Management, Vol. 44 (Third Edition 2018), 127-139.); low volatility (de Carvalho, Raul Leote., Patrick Dugnolle, Xiao Lu, and Pierre Moulin, “Low-Risk Anomalies in Global Fixed Income: Evidence from Major Broad Markets,” Journal of Fixed Income Vol. 23 (2014), pp. 51-70). All data is from sources believed to be reliable but cannot be guaranteed or warranted.